How a Home Loan Calculator Can Help You Price Quote Monthly Settlements Accurately

How a Home Loan Calculator Can Help You Price Quote Monthly Settlements Accurately

Blog Article

Ingenious Lending Calculator: Encouraging Your Budgeting Strategies

In the realm of personal finance, the importance of reliable budgeting techniques can not be overemphasized. An innovative funding calculator stands as a tool that not only facilitates the understanding of numerous car loan choices but likewise help in decoding complex repayment timetables. Its influence transcends mere mathematical estimations; it plays a critical role in monitoring one's financial health and wellness and, ultimately, in optimizing budgeting approaches. By using the power of easy to use attributes, this calculator paves the means for an extra informed and encouraged technique in the direction of managing financial resources. This device's potential to revolutionize the method individuals browse their economic landscape is indisputable, using a look right into a realm where budgeting becomes greater than just number crunching.

Comprehending Funding Alternatives

When considering borrowing money, it is necessary to have a clear understanding of the numerous loan choices available to make educated monetary choices. One typical kind of loan is a fixed-rate loan, where the rates of interest continues to be the exact same throughout the funding term, offering predictability in month-to-month settlements. On the other hand, adjustable-rate finances have rate of interest that change based on market conditions, offering the capacity for lower first prices however with the threat of increased payments in the future.

An additional alternative is a protected car loan, which needs collateral such as a home or cars and truck to safeguard the obtained amount. This type of financing usually provides reduced rate of interest as a result of the reduced threat for the loan provider. Unsafe financings, nevertheless, do not need security but usually included greater rates of interest to compensate for the increased threat to the lending institution.

Comprehending these car loan choices is vital in choosing the most ideal financing remedy based on monetary conditions and specific needs. home loan calculator. By weighing the advantages and disadvantages of each type of lending, consumers can make well-informed decisions that straighten with their long-lasting monetary goals

Computing Repayment Routines

To properly manage car loan settlement obligations, understanding and properly calculating repayment schedules is extremely important for maintaining economic stability. Calculating repayment routines involves figuring out the total up to be repaid periodically, the regularity of repayments, and the total duration of the loan. By damaging down the overall car loan quantity into manageable routine settlements, consumers can budget plan properly and make certain prompt settlements, hence preventing late fees or defaults.

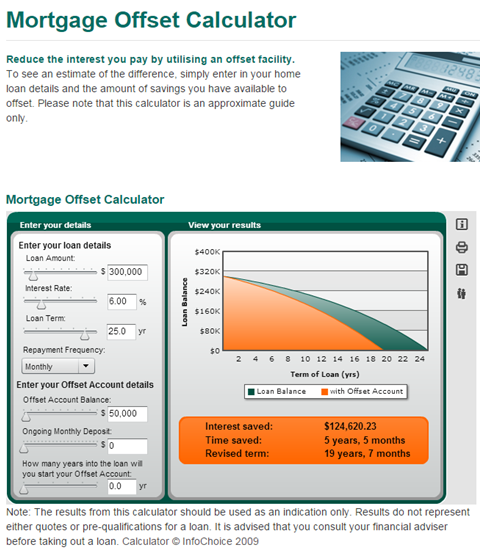

There are different approaches to determine repayment schedules, consisting of the usage of car loan amortization timetables or online financing calculators. Car loan amortization routines supply an in-depth malfunction of each payment, demonstrating how much of it goes towards the principal amount and just how much towards passion. Online car loan calculators simplify this procedure by enabling individuals to input funding information such as the major amount, rates of interest, and funding term, generating a payment routine quickly.

Calculating and comprehending repayment schedules not only aid in budgeting but additionally give debtors with a clear review of their economic commitments, allowing them to make educated decisions and remain on the right track with their payment obligations.

Surveillance Financial Health

Keeping an eye on economic health and wellness includes consistently analyzing and assessing one's economic status to guarantee stability and educated decision-making. By keeping a close eye on crucial financial signs, people can identify potential problems early on and take aggressive procedures to address them.

Additionally, checking cost savings and investments is necessary for long-lasting monetary well-being. Frequently assessing investment portfolios, pension, and emergency situation funds can aid individuals assess their progress in the direction of conference financial objectives and make any kind of needed changes to maximize returns. Keeping track of financial debt degrees and credit rating is likewise essential in examining overall economic wellness. Monitoring financial debt balances, rates of interest, and credit report utilization can aid people handle financial debt successfully and preserve a healthy credit report profile.

Making The Most Of Budgeting Techniques

In enhancing budgeting approaches, individuals can utilize different strategies to improve financial preparation and resource allowance successfully. One key technique to optimize budgeting techniques is via establishing clear internet financial goals.

Furthermore, focusing on financial savings and financial investments in the budget can aid individuals secure their economic future. By assigning a section of revenue in the direction of financial savings or retired life accounts prior to various other costs, people look at more info can build a safeguard and job towards long-term financial stability. Looking for specialist guidance from financial coordinators or advisors can likewise help in maximizing budgeting approaches by obtaining customized advice and proficiency. In general, by utilizing these methods and remaining disciplined in budget plan administration, individuals can properly optimize their financial sources and achieve their financial objectives.

Using User-Friendly Functions

Verdict

To conclude, the ingenious loan calculator supplies a valuable tool for individuals to recognize loan choices, determine settlement routines, screen financial health and wellness, and make best use of budgeting methods. With straightforward features, this tool equips individuals to make informed monetary choices and plan for their future monetary objectives. By making use of the lending calculator properly, people can take control of their funds and achieve higher economic security.

Keeping track of financial health and wellness includes routinely analyzing and evaluating one's monetary condition to ensure security and informed decision-making. Overall, by utilizing these strategies and staying disciplined in budget administration, individuals can properly enhance their financial sources and have a peek at this site achieve their monetary goals.

In verdict, the cutting-edge funding calculator uses an important device for individuals to comprehend finance choices, determine settlement schedules, monitor financial wellness, and make best use of budgeting approaches. With easy to use features, this tool encourages users to make educated financial decisions and strategy for their future economic objectives. By utilizing the funding calculator properly, individuals can take control of their financial resources and accomplish greater monetary security.

Report this page